Employment Law Q&A: FFCRA & Return to Work Guidelines

On Tuesday, August 25, MCMS hosted a Q&A for physicians with James Hammerschmidt, Esq. and David Shapiro, Esq. of Paley Rothman, a Bethesda based law firm. The session began with a summary of developments related to the Families First Coronavirus Response Act (FFCRA) and CDC’s “Return to Work” guidelines, followed by a Q&A of participant submitted questions. To view the full session, visit MCMS’s YouTube channel. The following is a summary of the session with key takeaways and a summary transcription of the Q&A, which included questions concerning disagreements between physicians about use of telemedicine, staff participating in high-exposure activities on personal time, and more.

Families First Coronavirus Response Act (FFCRA)

The Families First Coronavirus Response Act was signed on March 18, 2020 and is effective April 1, 2020 through December 31, 2020. It impacts businesses/employers in four key ways:

- requires some employers to provide paid family and medical leave;

- requires some employers to provide paid sick leave;

- provides tax credits for employers to pay mandated leave;

- expanded unemployment (expired and replaced by Executive Order – $300/federal; $100/Maryland).

FFCRA addresses leave benefits in two ways, through the Emergency Family and Medical Leave Expansion Act (EFMLEA) and the new Federal Paid Sick Leave Law (PSLL).

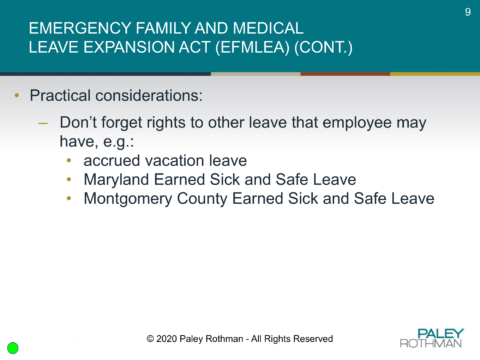

EFMLEA only covers employers with 500 or fewer employees, and an employee must be employed for 30 days to be eligible. It applies only when employee needs leave for a COVID-19 related school or child-care closure. In this case, the employee is entitled to 12 weeks of leave, the first 10 days of which may consist of unpaid leave (subject to other leave benefits that employee may elect to use), and then, employee must be paid at 2/3 the employee’s regular pay rate – up to $200 per day/per employee (up to maximum of $10,000 aggregate/per employee). Businesses with fewer than 50 employees can apply for an exemption to EFMLEA. Additional details are provided in the slide deck above.

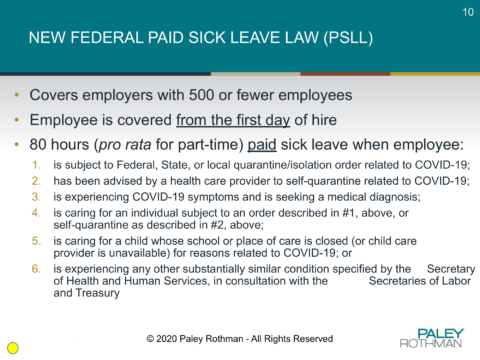

PSLL also covers employers with 500 or fewer employees. An employee is covered from the first day of hire. It provides 80 hours (pro rata for part-time) of paid sick leave when employee:

- is subject to Federal, State, or local quarantine/isolation order related to COVID-19;

- has been advised by a health care provider to self-quarantine related to COVID-19;

- is experiencing COVID-19 symptoms and is seeking a medical diagnosis;

- is caring for an individual subject to an order described in #1, above, or self-quarantine as described in #2, above;

- is caring for a child whose school or place of care is closed (or child care provider is unavailable) for reasons related to COVID-19; or

- is experiencing any other substantially similar condition specified by the Secretary of Health and Human Services, in consultation with the Secretaries of Labor and Treasury.

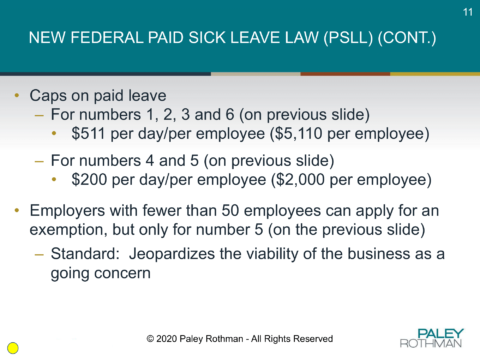

Under the PSLL, the caps on paid leave for numbers 1, 2, 3 and 6 (above) are $511 per day/per employee ($5,110 per employee), and for numbers 4 and 5 (above) $200 per day/per employee ($2,000 per employee). Employers with fewer than 50 employees can apply for an exemption, but only for number 5 (above). The standard for an exemption is that the requirement jeopardizes the viability of the business as a going concern.

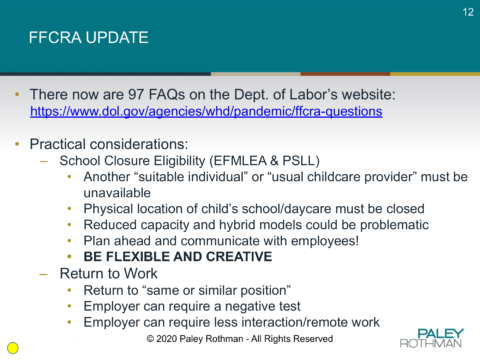

Most questions related to the application of FFCRA are covered in the Department of Labor’s 97 FAQs. Some other practice considerations for the FMLEA are:

1. School Closure Eligibility (EFMLEA & PSLL)

- Another “suitable individual” or “usual childcare provider” must be unavailable

- Physical location of child’s school/daycare must be closed

- Reduced capacity and hybrid models could be problematic

- Plan ahead and communicate with employees!

2. Return to Work

- Return to “same or similar position”

- Employer can require a negative test

- Employer can require less interaction/remote work

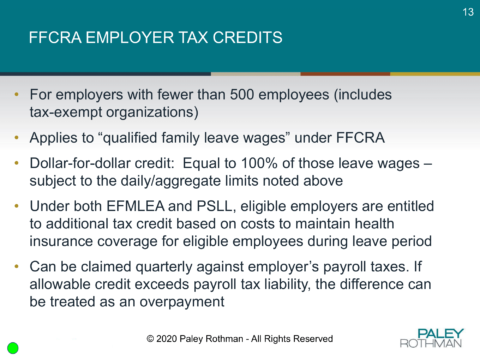

For employers with fewer than 500 employees (includes tax-exempt organizations), FFCRA Employer Tax Credits are available, which apply to “qualified family leave wages”. This is a dollar-for-dollar credit equal to 100% of those leave wages, subject to the daily/aggregate limits noted above. Under both EFMLEA and PSLL, eligible employers are entitled to additional tax credit based on costs to maintain health insurance coverage for eligible employees during leave period. The credit can be claimed quarterly against employer’s payroll taxes. If allowable credit exceeds payroll tax liability, the difference can be treated as an overpayment.

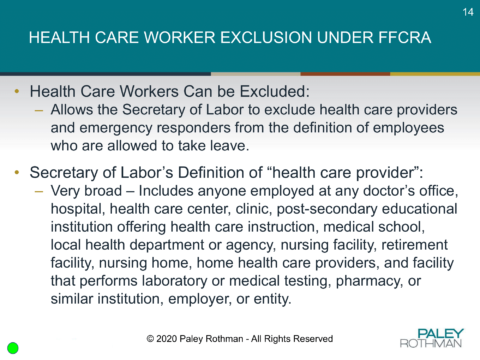

There is a health care provider exclusion from the definition of employees who are allowed to take leave. The Secretary of Labor’s Definition of “health care provider” is very broad; it includes anyone employed at any doctor’s office, hospital, health care center, clinic, post-secondary educational institution offering health care instruction, medical school, local health department or agency, nursing facility, retirement facility, nursing home, home health care providers, and facility that performs laboratory or medical testing, pharmacy, or similar institution, employer, or entity. Consult your attorney about how this might apply to your practice.

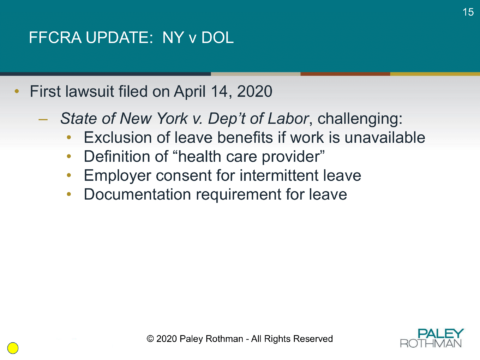

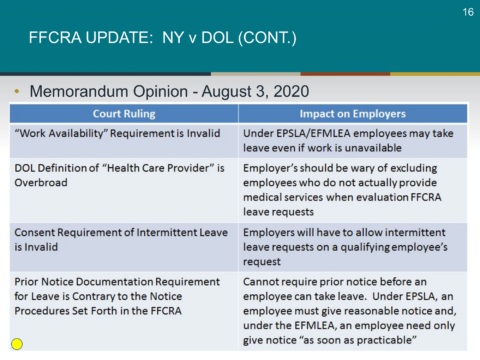

A lawsuit filed on April 14, 2020, State of New York v. Dep’t of Labor, challenged certain provisions of FMLEA, and the decision has introduced uncertainty to its application. What does this mean for you? Proceed as if the decision applies to your practice:

- Allow intermittent leave.

- Allow an employee to take leave even if no work is available (we know … this makes no sense).

- Don’t condition leave on prior notice.

- If you are a health care provider, don’t exclude the janitor.

Additional details are available in the slide deck and session recording.

COVID-19 Return to Work Guidelines

Protect your business by following CDC and OSHA Guidelines, while keeping in mind that CDC guidance is meant to supplement, not replace, state and local regulations. Key Resources:

- OSHA’s Guidance on Returning to Work & Preparing Workplaces for COVID-19

- CDC’s Website for Businesses and Workplaces

- CDC’s General Business FAQs

- CDC’s Interim Guidance for Businesses and Employers

As part of a return to work plan, EEOC suggests notifying employees that the company is willing to be flexible, that it will

provide accommodations, and who to contact and accommodating requests for alternative screening. Employers cannot involuntarily exclude older workers only because they are at higher risk, but can offer additional flexibility to those workers. It’s important to not make gender-based assumptions of who may have caregiving responsibilities. In cases of employee pregnancy, employers cannot involuntarily exclude an employee due to pregnancy, and pregnancy-related medical conditions may trigger reasonable accommodation. An employer must offer same modification to all employees who are similarly situated in their ability to work.

Some additional practical considerations: Beware of growing vacation accruals and liabilities! Consider implementing leave policy changes now and/or stopping leave accrual. For continuation of telecommuting, have a formal policy in place that explains how telecommuting decisions are made, that not all jobs are suitable for telecommuting, addresses equipment the company will and will not provide makes clear that telecommuting may be temporary and

does not set a precedent, states that employees must continue to abide by all policies, addresses job duties and work hours, explains telecommuting is not a substitute for dependent care, addresses safety issues, and addresses information technology and confidentiality issues.

Employment Law Q&A

Q: If an employee works in a medical setting and wants to exercise leave rights, what are the options?

A: If the employee has been required to quarantine or isolate or has COVID symptoms, that will trigger the 80 hours right to leave. General anxiety in returning to work is not covered by the FMLEA, and concern about returning to work is not sufficient to trigger the leave. However, they may be able to use accrued leave time or can check into options with unpaid leave status – furlough, etc. If you’re in a hospital or facility – be sure of the role that the employee is playing within the organization; there may be exemptions for having to comply.

Q: Is the 80 hours of coverage under FFCRA a one time only benefit per employee?

A: Yes it is, but be mindful of the guidance about intermittent leave. While an employee is only able to get their 80 hours leave once, keep in mind that it could be incremental (2 days here, three days there, etc.)

Q: If a physician employee doesn’t want to come in to outpatient practices due to fear of getting COVID and thinks that all outpatient encounters should be delivered via telehealth, is there a risk of legal accusations of retaliation for terminating these physicians?

A: Generally speaking, a fear or anxiety does not trigger leave rights under FFCRA

In this case, a disagreement within practice about how things should be run, if there is an employee complaining about protected rights, be sensitive to the fact that you could end up in a situation if the person complains about “I had a right to complain about X and I was terminated for that”. IF the issue that the practice is dealing with has to do with the complaint about how the care is delivered, I would handle that differently than if the concern is about COVID or getting COVID.

If you have an employee that has something beyond standard anxiety, and someone comes to you with a doctor’s note stating the person has a higher level anxiety. Be mindful, this could get into a situation where someone possibly has a disability or falls under the Americans with Disability Act and could need an accommodation

3 takeaways:

- If just standard anxiety: does not trigger leave under FFCRA

- If it is a retaliation issue for an employee complaining and then being terminated: could be stepping into legal waters, seek legal counsel first

- If this elevates beyond standard anxiety: be mindful of other legal obligations to the employee, outside of COVID and FFCRA

Q: How do I limit liability from patients suing me if they contact trace to someone that works at my office (e.g., a physical therapist or staff person)?

A: There are protocol driven ways to respond to patients and a situation where someone may have contracted COVID within the office. The best way to avoid this is to make sure you’re doing your best to comply with all CDC requirements and guidance out there – there is an understanding that you can’t prevent 100% of this virus. It is incredibly difficult to trace exactly where someone contacted COVID. There will be a high level burden of proof on top of everything else. Make sure staff is wearing PPE – gloves, gowns, facemasks/goggles and remember that staff isn’t only wearing all of this to keep themselves safe, they are also wearing it to keep patients safe.

Q: If there is a known COVID-19 exposure in the medical office, can all of the workers work unless they become symptomatic?

A: Prudence should be your guide. You should want to look at quarantine or testing and absolutely stepping up PPE. Be cautious of exposing patients. This is different than the above question because this creates a known situation and you want to be cautious of exposing the office to further risk.

Q: Are front desk staff/receptionists included as “health care personnel” in the CDC definition?

A: The New York lawsuit touched on this. Be mindful of treating staff and receptionists different than hands-on providers. This is case by case analysis.

Q: Can we tell employees that they cannot go to the beach or participate in any high risk COVID-19 activities (e.g., go to a wedding) due to potentially exposing the office? If an employee goes to a high-risk location and needs to be quarantined until tested, do I need to pay the employee?

Just because we employee someone does not mean we can control every aspect of their lives. You can encourage staff to be careful, to know what they can bring back to their other office staff. You can’t prohibit people from going on vacation, a wedding, or a funeral. However, you can have office protocols that say “under these circumstances if you’re going to X or X, you can’t come and work in the office” you can work remotely (if that’s an option). You can require quarantine or a negative test before they come back. If that requirement doesn’t fall into the items on the family sick leave options, they aren’t necessarily due pay during that time.

Q: We have several employees who would like to reduce hours because they need to be home with their young children for remote learning. Nobody else in the family can help (other family members not English speaking). Can those hours be used for COVID leave under the stipulation that they need to be home with children because school is closed?

A: The simple answer is yes. The Emergency Family and Medical Leave Expansion Act provides that, for employees who have been employed for 30 days, they are entitled to up to 12 weeks of leave (the first 10 of which may be unpaid – subject to other leave rights they may have) if they need leave because their child’s school or child-care is closed. After the initial 10 days they must be paid at 2/3 of their regular rate of pay, up to $200 per day and a maximum of $10,000.

Similarly, the new federal Paid Sick Leave Law provides employees with up to 80 hours of paid sick leave to care for a child whose school or place of child care is closed for reasons related to COVID-19. Under the Paid Sick Leave Law the paid leave is capped at $2,000 (or $200 per day).

With respect to the obligation, however, remember that, if you pay these leave benefits pursuant to the Families First Coronavirus Response Act, you’ll will get an immediate tax credit for the funds expended, so the employer is not really footing the bill for these leave benefits, though, arguably, they are advancing the money.

Question: If these employees desire to use this leave, since we employee less than 50 employees, should we apply for an exemption because it would create a financial hardship for the practice?

A: We would stress that this exemption is intended to provide an unusual exception to the rule … not a general safety net for smaller employers. To qualify for this exemption the employer must look at more than their size. According to the FAQs published by the Department of Labor, a small business may claim this exemption if an authorized officer of the business has determined that:

a) The provision of paid sick leave or expanded family and medical leave would result in the small business’s expenses and financial obligations exceeding available business revenues and cause the small business to cease operating at a minimal capacity;

b) The absence of the employee or employees requesting paid sick leave or expanded family and medical leave would entail a substantial risk to the financial health or operational capabilities of the small business because of their specialized skills, knowledge of the business, or responsibilities; or

c) There are not sufficient workers who are able, willing, and qualified, and who will be available at the time and place needed, to perform the labor or services provided by the employee or employees requesting paid sick leave or expanded family and medical leave, and these labor or services are needed for the small business to operate at a minimal capacity.

If the employer is able to honestly make one of the determinations noted above, the employer is not required to physically “apply” for the exemption. Rather, the employer should carefully and fully document why the business meets the criteria to take advantage of the exemption. The employer should assume that employees impacted by this decision may challenge it, so having complete documentation to support the claimed qualification for the exemption is very important.

Follow-Up Q: We are under 50 employees at our “supergroup”…

While not really a question, we noted the term “supergroup” used by your member. If this employer is a “supergroup,” in that there are a number of independent practices that collaborate and have “affiliated” with one another for purposes of insurance bargaining/buying power, back-office collaboration, marketing, etc., then we would recommend that the employer first speak with their counsel about the number of employees that the employer will be deemed to have. For example, if a supergroup has 10 divisions, each of which has 10 employees, then it is possible that the employer (and each division of the supergroup) will be deemed to have 100 employees; not 10. Just something to think about.

Q: There was a statement from the New York appeal about paying for work even if work was unavailable. Would this apply when we furloughed our staff for 3 months in March thru May? If it did, do we have to notify our employees of this option or do they have to ask for it.

As we noted during our presentation, the New York federal court decision left many questions unanswered – a couple of which have been highlighted by your member. Here, our advice would be to deal with this on a “go forward” basis only. If, in the future, an employee is furloughed or the company does not have available work, but the employee comes forward seeking leave and is eligible and qualifies for federal Paid Sick Leave or Emergency Family Medical Leave Expansion Act leave, the employer should grant it to the employee. And, again, we would remind the employer that the employer is not really paying for the leave, because it would get an immediate payroll tax credit for any monies paid to the employee under the Families First Coronavirus Response Act.